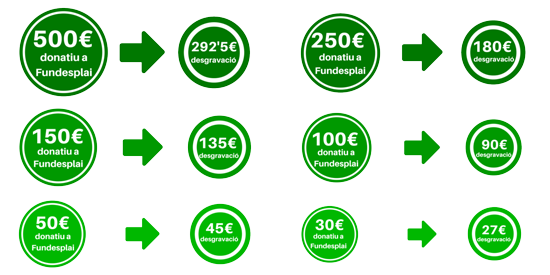

Donations from individuals to Fundesplai up to € 150 per year deduct 90%. For contributions per year of € 150, € 135 would be recovered.

Donating €150 to Fundesplai only costs €15

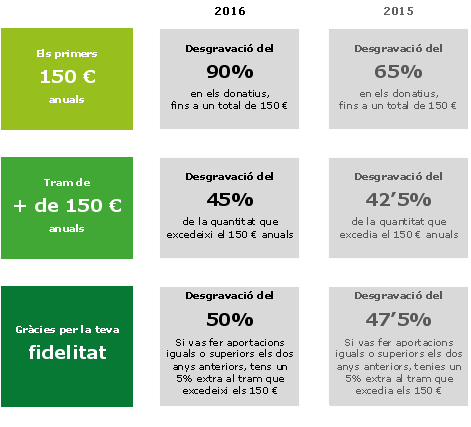

The tax reform that came into force in 2015 incorporated important novelties in relation to donations made to foundations and entities declared to be of public utility.

In the case of Fundesplai, donations from individuals up to an annual amount of € 150 deduct 75%, to which must be added 15% for belonging to the Census of entities promoting the Catalan language. Thus, out of a total of contributions per year of €150, €135 would be recovered in the Income Tax Return, which would end up costing only €15.

Do you want to make a donation to the Fundesplai scholarship campaign?

For amounts exceeding €150 per year, between 45% and 50% will be applied, depending on the contributions made in previous years to the same entity.

Incentives for companies

Regarding donations from legal entities, the percentage of deduction in Corporation Tax is 35%, but there is also an incentive for fidelity since it increases by 5% for those companies that have made a donation equal to or greater in the previous two years.

More information on this link.

Collaborate with the scholarship campaign “A summer for everyone”

Last year Fundesplai awarded 4,774 scholarships to families with few economic resources, allowing children and adolescents access to summer activities. This year, the goal is to be able to meet all the requests we receive (more than 5,000). Can you help us achieve this?